Table of Content

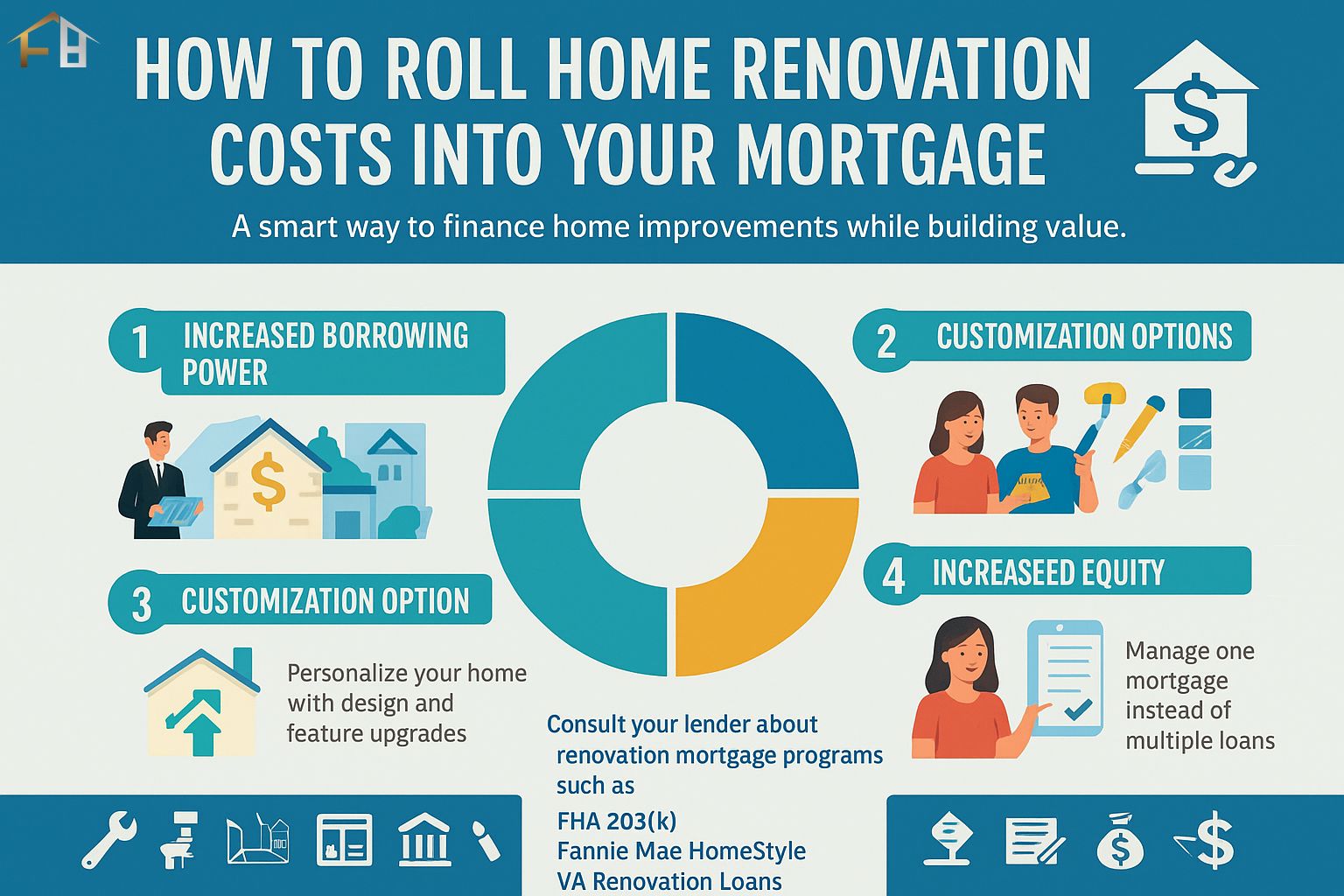

Combining home loans with other expenses, such as makeovers, is essential, as it can reduce closing costs. You can do so with a new purchase or years later when refinancing an existing mortgage loan to include these expenses. Continue reading to learn the advantages that come with including home renovation costs in your mortgage payment.

Increased Borrowing Power

Accessing larger loans is essential, both now and in the future. When adding renovation expenses to a mortgage loan, you can do just that, whether it’s for the changes themselves, purchasing a new property, and other financial needs. The increased flexibility leads to additional opportunities and potentially secures more favorable lending terms and interest rates.

With a traditional loan, you borrow based on the property’s current market value. However, adding the renovation gives you the ability to borrow on the projected value before the makeover is complete. As a result, your borrowing power increases, allowing you to request more money up front, which covers both the renovations and the purchase price of your property.

Customization Options

Tailoring the home to your lifestyle and needs is easier to achieve when you decide to do home renovations. You not only boost the enjoyment of the property, but you can also enhance its functionality. The home could lack the chef’s kitchen you always wanted but never acquired, or it could incorporate a spa-like bathroom that reflects your individual preferences.

Adding renovation expenses to your mortgage boosts your customization options, giving you the power to tailor those changes without worrying about the costs. You can undertake more personalized steps by combining the loans instead of using current savings or credit cards.

Increased Equity

Increased Equity

Obtaining better loan terms, increasing your net worth, and maintaining financial flexibility and security are easier to do when you boost your home’s equity. By including home renovations in your mortgage, you can accelerate your equity growth through customization, thereby increasing the house’s market value.

Remember that bathroom remodeling, energy-efficiency improvements, and simply enhancing your curb appeal can add value quickly, often exceeding the actual costs of the renovations. Professional contractors who provide Encinitas full home remodeling design services should review strategic improvements that offer a good return on investment and enhance the existing equity.

Simplified Overall Process

Ensuring accurate renovation expenses can make the process easier to manage. You can streamline your finances into a single loan with monthly payments, allowing you to budget more easily with your mortgage and other personal expenses. The interest rate could decrease, keeping the renovations more affordable than using credit cards and other personal loan options.

There are generally requirements for including home renovation costs in your mortgage loan. These are based on different factors, such as lenders conducting assessments of the property value after the changes are complete. Your credit score and down payment amounts can be other aspects to consider, based on the planned work and estimated costs. However, simplifying financing and maintaining a desirable property that increases its value can make the overall process worthwhile and straightforward.

When you’re ready to renovate your home, make sure to hire the best contractors in the business. The team from Forever Builders are the experts you can trust to provide the most affordable home remodeling services and ensure your vision becomes reality. From design to completion, we’ll help you create the home you’ve always wanted, meeting all your expectations while keeping your costs within budget. To find out more about our outstanding remodeling services, give one of our friendly team members a call today for your own Encinitas remodel design consultation.

Increased Equity

Increased Equity